Foundation Report

The University of Georgia Foundation enriches the quality of education at the University of Georgia by supporting scholarships, endowed chairs and professorships, and other programs that rely on private funds. The Foundation manages $1.4 billion in assets, more than $1.1 billion of which is endowed, and provides an average of more than $75 million annually to UGA to advance its mission of teaching, research, and service.

The UGA Foundation’s Board of Trustees, comprised of 50 volunteer members, oversees the work for the Foundation. Trustees lead and promote fundraising activities, accept and steward donor funds, and manage the Foundation’s financial assets for the long-term benefit and enhancement of the University. Trustees also offer broad advice, consultation, and support to University leadership.

Since the organization was established in 1937, the Foundation’s assets have grown tremendously. This year, its long-standing record of success continued when UGA surpassed the $1.2 billion goal for the Commit to Georgia Campaign 16 months ahead of schedule, which will enable the Foundation to provide more support than ever before.

Georgia Commitment Scholarship program

Since January 2017, the UGA Foundation has been matching gifts of $50,000, $75,000, or $100,000 to establish endowed need-based scholarships for undergraduates. This program constitutes a meaningful step toward eliminating financial obstacles for those seeking a UGA education.

In 2018–19, the University surpassed its goal of creating 400 new Georgia Commitment Scholarships.

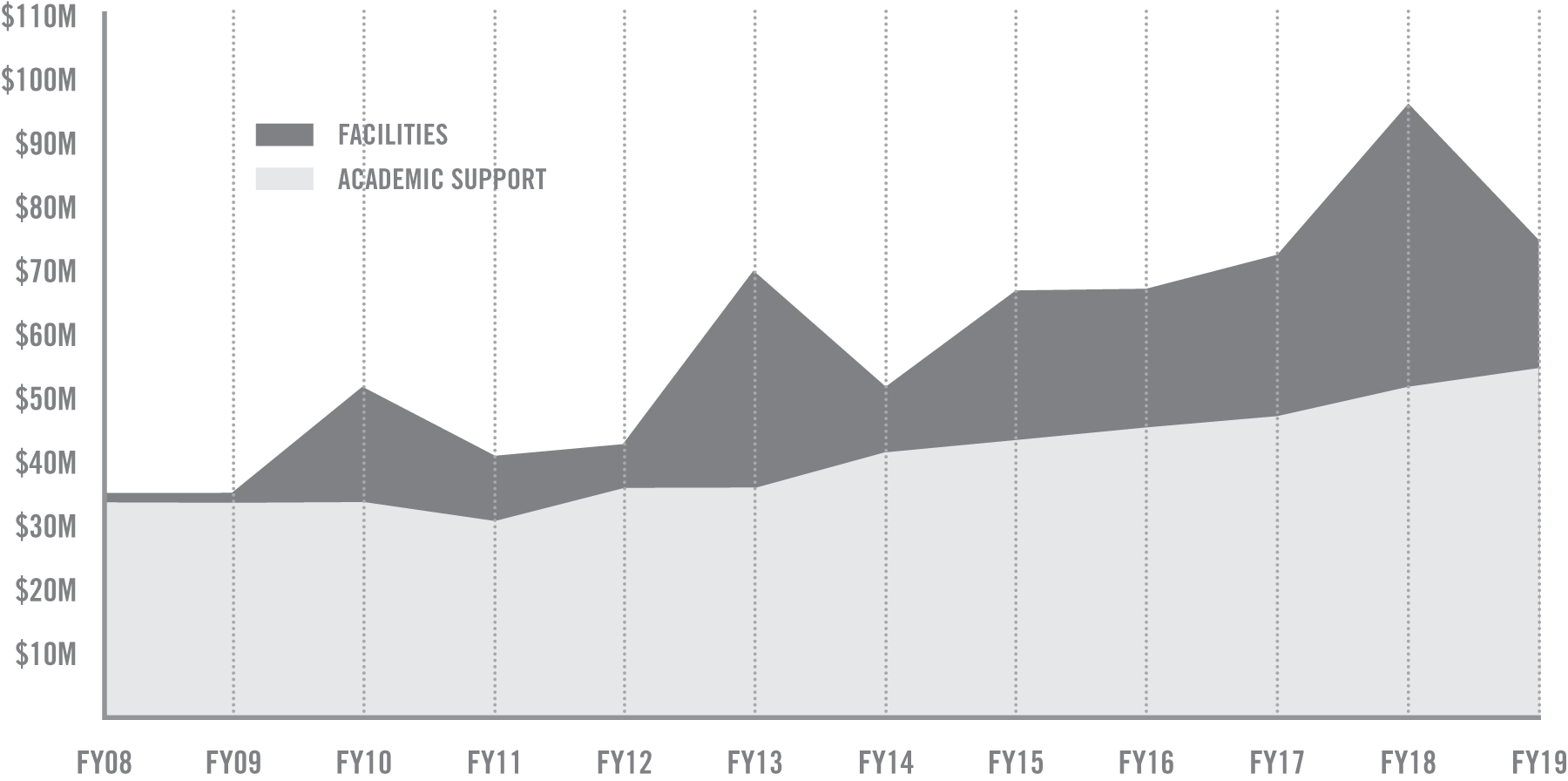

Foundation support of UGA

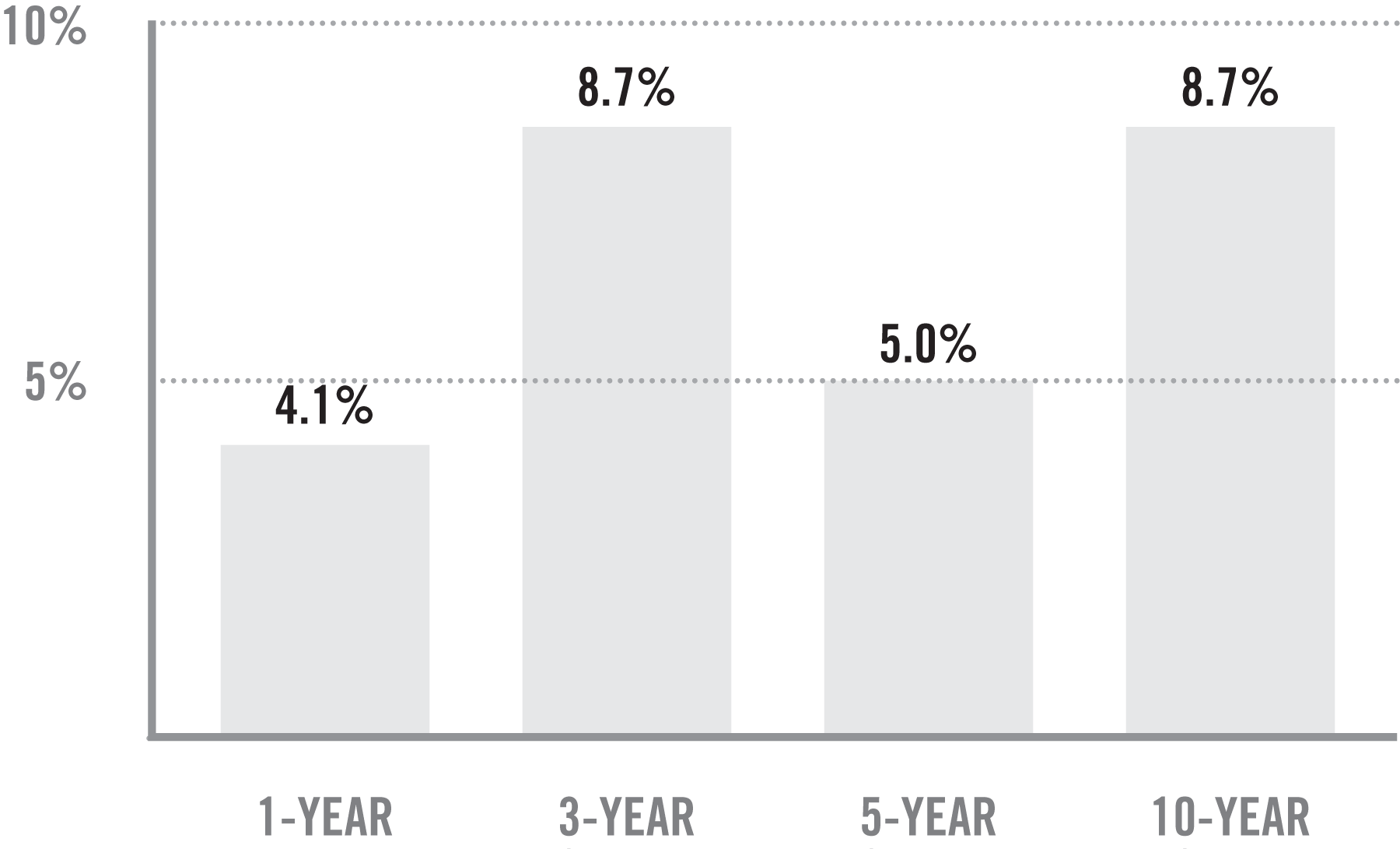

Long-term investment return*

Endowments: Creating A Legacy of Generosity

An endowment is an opportunity for a donor to create a permanent legacy at the University of Georgia and allow future generations to benefit from today’s generosity. When an endowment is established with a new donation, the gift is invested with two goals in mind: to provide spendable income for the donor’s specified purpose and to grow the principal faster than inflation. Any investment return that exceeds allowed spending is channeled back into the fund to increase growth.

* The Foundation’s fiscal year ended June 30. Investment returns are preliminary, with some investment managers not yet reporting as of the date of publication.

UGA foundation’s investment portfolio allocation

| Asset Class | June 30 Allocation | Asset Characteristics |

|---|---|---|

| Publicly Traded Equities | 49.2% | Capital appreciation, global diversification, highly liquid |

| Cash and Fixed Income | 14.0% | Capital preservation and income, highly liquid |

| Private Equity | 7.2% | High return potential, illiquid |

| Hedge Funds | 14.2% | Moderate return potential with reduced volatility |

| Real Assets | 15.4% | Inflation hedge and income generation |